On Thursday, equity investors stayed bullish, selectively buying stocks as lower treasury bill yields and a declining Kibor rate helped extend the previous day’s gains in the benchmark index.

Ahsan Mehanti from Arif Habib Corporation noted that stocks continued their upward trend following a government decision to reduce returns on various tenors of T-bills by up to 148 basis points. This move heightened expectations for a third consecutive rate cut by the State Bank of Pakistan next month.

Banking and fertilizer stocks performed well due to rising fertilizer prices and increased banking deposits. Investor sentiment was also boosted by the finance minister’s assurance of ongoing engagement with the IMF and progress toward securing the executive board’s approval for a $7 billion Extended Fund Facility next month.

Topline Securities reported that Karachi interbank offered rates fell below 18% for the first time in 19 months. “Kibor is declining in anticipation of lower inflation numbers, which is leading to expectations for another rate cut by the SBP at its monetary policy meeting on September 12,” the firm noted.

The cement and steel sectors showed notable optimism, with companies like Fauji Fertiliser, Service Industries, National Bank, PSO, and Lucky Cement collectively adding 355 points to the index. However, profit-taking in stocks such as Habib Bank, Engro Corporation, Millat Tractor, and Meezan Bank resulted in a loss of 132 points.

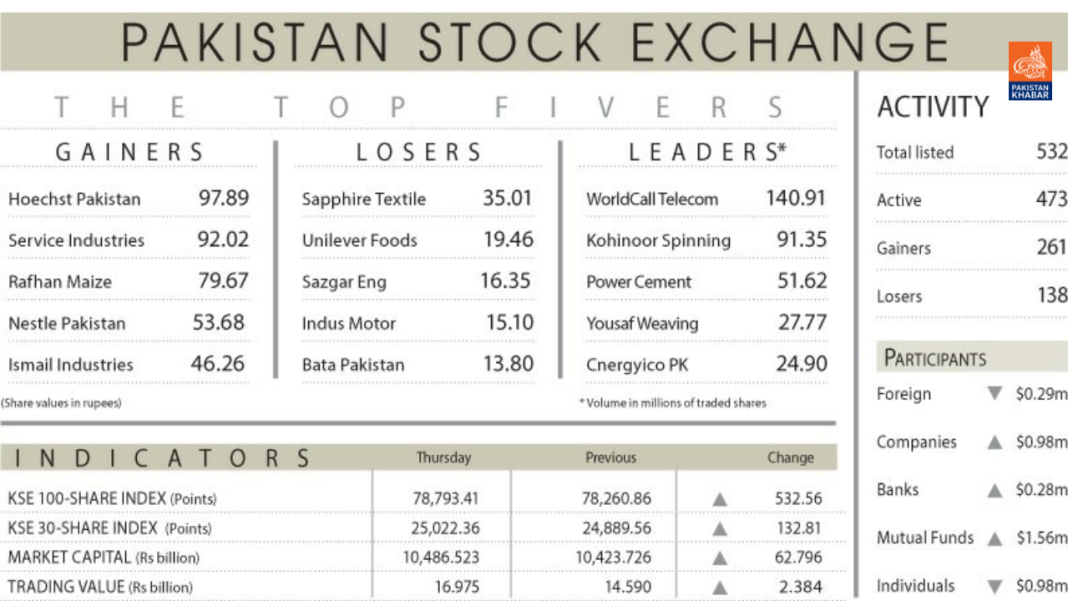

The KSE-100 index continued its upward trend, gaining 735 points intraday before closing at 78,793.41, an increase of 523.56 points or 0.68% from the previous day.

Trading volume surged by 45.55% to 804.26 million shares, and the traded value increased by 16.34% to Rs16.97 billion.

Notable stocks in terms of traded volume included WorldCall Telecom (140.9 million shares), Kohinoor Spinning Ltd (91.35 million shares), Power Cement (51.62 million shares), Yousuf Weaving (27.77 million shares), and Cnergyico PK (24.90 million shares).

Stocks with the largest price increases included Hoechst Pakistan Ltd (Rs97.89), Service Industries (Rs92.02), Rafhan Maize Products Company Ltd (Rs79.67), Nestle Pakistan (Rs53.68), and Ismail Industries Ltd (Rs46.26).

Conversely, the stocks with the most significant price decreases were Sapphire Textile Mills Ltd (Rs35.01), Unilever Pakistan Foods Ltd (Rs19.46), Sazgar Engineering Works Ltd (Rs16.35), Indus Motor Company Ltd (Rs15.10), and Bata Pakistan (Rs13.80).

Foreign investors were net sellers, offloading shares worth $0.29 million.