On Monday, Pakistani stocks faced selling pressure due to uncertainty surrounding the upcoming budgetary measures. Despite starting positively with low volume, the benchmark KSE 100 index turned red.

Ahsan Mehanti from Arif Habib Corporation mentioned that the market became bearish following reports of a proposed tax collection target of Rs12.5 trillion for FY25, which could impact industrial earnings. Additionally, concerns over over-leveraging and uncertainties regarding negotiations to repay dues to Chinese IPPs weighed on market sentiment.

Investors chose to reduce their positions, leading to the market settling below 76,000 levels after reaching an intraday high at 76,188 points, with a gain of 204 points during the day. Budgetary concerns and mixed IMF sentiments contributed to a relatively lackluster momentum.

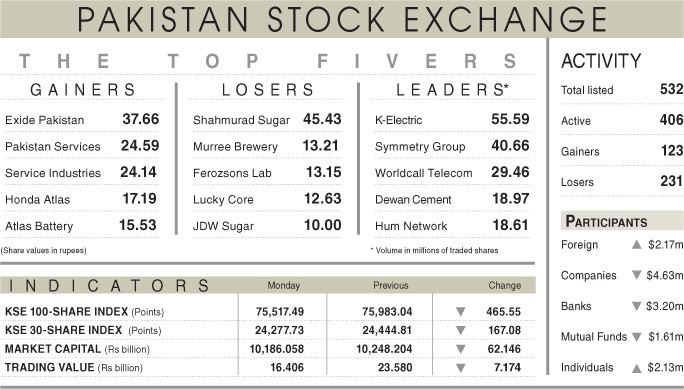

As a result, the fertiliser, banks, and E&P sectors performed negatively, with stocks like Fauji Fertiliser, MCB Bank, Pakistan Petroleum Ltd, OGDC, and Bank Alfalah experiencing losses. Conversely, Faysal Bank, HBL, and Systems Ltd contributed positively. The KSE 100 index closed at 75,517.49 points, down by 465.55 points or 0.61% on a day-on-day basis.

Trading volume decreased by 26.85% to 446.07 million shares, and traded value dropped by 30.42% to Rs16.40bn day-on-day. Notable contributors to the traded volume included K-Electric Ltd, Symmetry Group Ltd, WorldCall Telecom, Dewan Cement, and Hum Network.

Companies that saw significant increases in share prices included Exide Pakistan Ltd, Pakistan Services Ltd, Services Industries Ltd, Honda Atlas Cars (Pakistan) Ltd, and Atlas Battery Ltd. Conversely, Shahmurad Sugar Mills Ltd, Murree Brewery Company Ltd, Ferozsons Laboratories Ltd, Lucky Core Industries, and JDW Sugar Mills Ltd experienced notable decreases in share prices.

Foreign investors became net buyers, purchasing shares worth $2.17m.