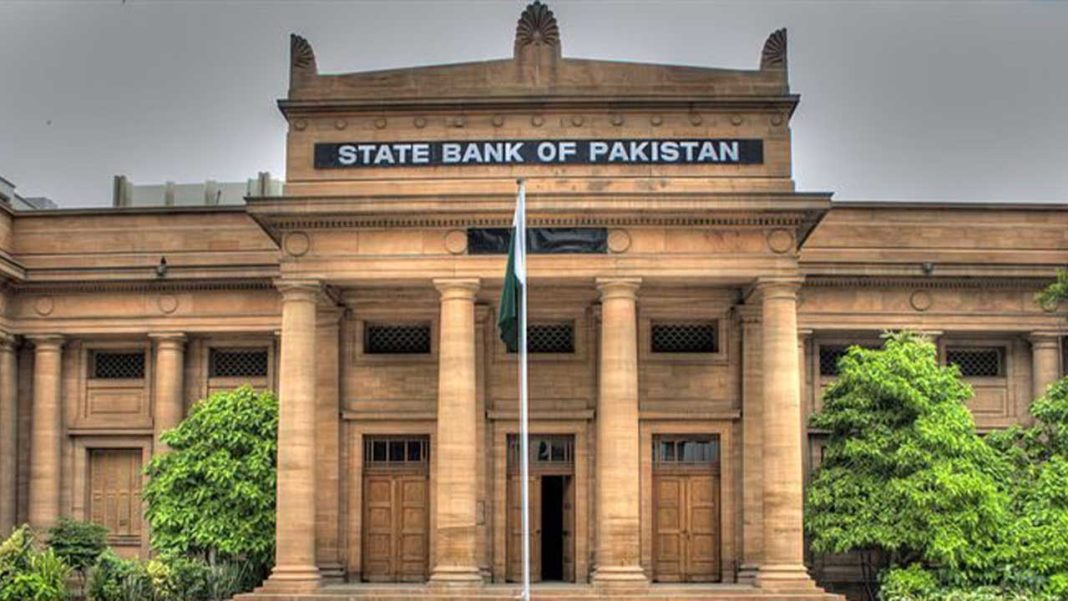

The State Bank of Pakistan’s foreign exchange reserves have surged to a two-year high, exceeding $9 billion following inflows from the International Monetary Fund (IMF).

According to the latest data released by the central bank on Thursday, foreign exchange reserves rose to $9.120 billion by the end of the week on May 3.

“The SBP reserves increased by $1.114 billion to $9.120 billion during the week, primarily due to the receipt of $1.1 billion from the IMF as the final tranche under the Stand-By Arrangement (SBA),” stated a release from the bank. The country’s total forex reserves now stand at $14.458 billion, including $5.338 billion held by commercial banks.

SBP’s reserves stood at $9 billion in mid-July 2022, but have been declining since then. By the end of FY23, the State Bank’s forex reserves had fallen to $4.4 billion in June 2023, putting the country close to a sovereign default.

In response, the SBP implemented measures such as restrictions on large-scale imports and repatriation of foreign investment profits to control dollar outflows. The approval of the SBA facilitated inflows from other sources, including funds from Saudi Arabia, UAE, and rollover of payments from China.

During a period of political and economic uncertainty, the Pakistani rupee faced significant depreciation, reaching Rs306 against the US dollar in the interbank market and Rs340 in the open market. To stabilize the exchange rate, measures were taken to curb dollar smuggling, resulting in a more stable exchange rate around Rs278-280 in recent months.

In other economic news, remittances from overseas Pakistanis surged by 28 percent in April, reaching $2.81 billion compared to the same period last year. The country received a total of $23.85 billion in remittances during the first 10 months of FY24, marking a 3.5 percent increase from the previous year.

Saudi Arabia accounted for the highest inflow of remittances at $5.8 billion during July-April 2023-24, representing a growth of 5.5 percent compared to the same period last year.

With the current account deficit narrowing to about half a billion dollars in nine months, the deficit could potentially reach zero by the end of this fiscal year. This positive trend in remittances is crucial for reducing the government’s borrowing needs for foreign debt servicing in the next fiscal year, provided the current account deficit remains under control.