After facing losses overnight due to nervous selling by investors concerned about a potential shift in US policy following Donald Trump’s win, the stock market resumed its upward momentum on Thursday, pushing the KSE-100 index to a record high above 92,500.

The previous downtrend on the local bourse contrasted with the global bull market, where Wall Street, the US dollar, and Bitcoin hit record highs. However, oil and gold futures saw some declines amid rising hopes for peace in the Middle East following the US elections.

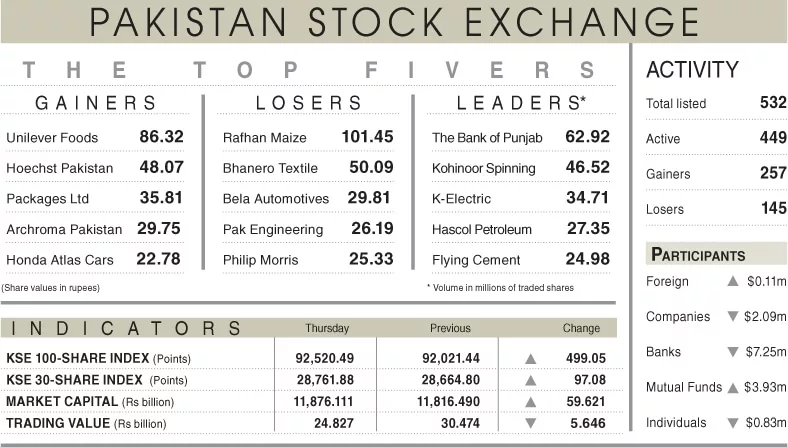

The KSE-100 index gained 673.10 points to reach 92,694.54, dipping 164.25 points to 91,891.47 at one point during the day. It ultimately closed at an all-time high of 92,520.49, up by 499.05 points or 0.54% from the previous day.

Ahsan Mehanti of Arif Habib Corporation attributed the bullish trend to investor optimism, driven by expectations of a rating upgrade following the finance minister’s assurances on macroeconomic stability. The anticipated reweighting of MSCI’s standard index, increasing Pakistan’s weight to 4.4% from November 26, also played a role, driven by market outperformance and liquidity.

MSCI’s recent review added eight Pakistani companies to its Frontier Market Small Cap Index but removed TRG Pakistan from its Frontier Markets Index.

Additional factors contributing to the market’s strong performance included a global bull run in equities, falling lending rates, over $3 billion in remittances in October, and rising exports.

Topline Securities Ltd noted that the bullish trend was further fueled by the Ijara Sukuk auction, where the one-year Sukuk’s cut-off yield fell to 10.99%, signaling a potential decline in yields for upcoming Treasury bill and Pakistan Investment Bond auctions.

Investor interest was also sparked by the prime minister’s recent visit to Saudi Arabia and the delegation’s trip to the kingdom, with new investments expected, including the Reko Diq project.

This news boosted stocks in Oil and Gas Development Company Ltd and Pakistan Petroleum Ltd.

Engro Corporation, Dawood Hercules, OGDCL, Hub Power, and Engro Fertilizer collectively contributed 475 points to the index, while major losers included Systems Ltd, Habib Bank Ltd, Meezan Bank Ltd, Kohat Cement, and Chetrat Cement, which together deducted 173 points.

The trading volume dropped by 23.66% to 678.78 million shares, and its value decreased by 18.52% to Rs24.82 billion day-on-day