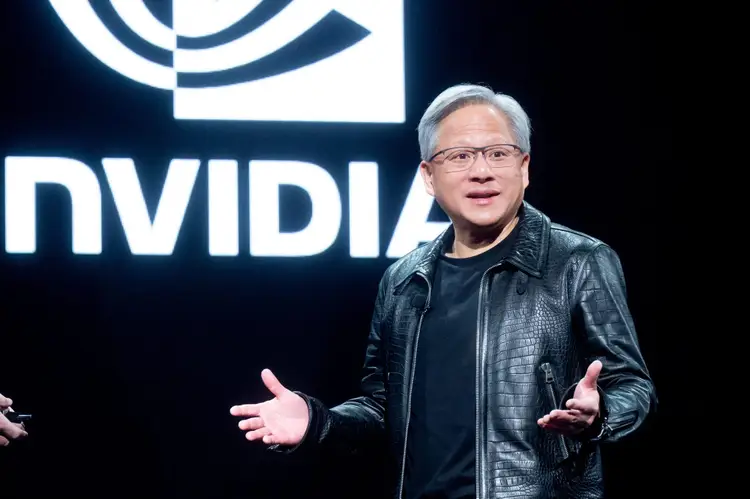

SAN FRANCISCO: For how much longer can Nvidia (NVDA.O) and its CEO, Jensen Huang, maintain their dominance as the leading supplier of artificial intelligence chips in the tech industry?

The duration of their supremacy—whether it spans months, years, or even decades—will be a critical question as Huang, who co-founded Nvidia in 1993 and has served as CEO ever since, takes the stage at a Silicon Valley hockey arena on Monday to unveil the company’s latest flagship products.

The event marks Nvidia’s annual developer conference, the first to be held in person since the onset of the pandemic. Nvidia anticipates an attendance of 16,000 individuals at its GTC event, doubling the number of attendees compared to the 2019 in-person show.

Nvidia’s market capitalization exceeded $2 trillion in late February, and it currently stands at approximately $400 billion away from surpassing Apple (AAPL.O) as the second-most valuable company on Wall Street, following Microsoft (MSFT.O).

Analysts project Nvidia’s revenue to surge by 81% this year to reach $110 billion, as companies rapidly adopt its cutting-edge chips for various AI applications, including chatbots and image generators.

This expected revenue is double what analysts anticipate for Intel (INTC.O), the chipmaker that dominated the personal computer boom. The crucial question for Nvidia is whether it can leverage its substantial lead in AI computing to establish long-term dominance in the evolving computing landscape.

Central to this endeavor will be Nvidia’s next-generation high-end AI processor, expected to be named the B100. This chip will serve as the cornerstone of Nvidia’s AI systems and is likely to begin shipping later this year.

Demand for Nvidia’s existing AI chips has exceeded supply, with software developers facing lengthy wait times to access AI-optimized computers from cloud providers.

Although Nvidia has not disclosed specific pricing, the B100 is expected to be more expensive than its predecessor, which retails for over $20,000.

Nvidia’s stock has surged by 83% in 2024, following a tripling in value the previous year. Despite this rapid growth, Nvidia’s current price-to-earnings (PE) ratio of 34 is considered relatively modest compared to its PE of 58 a year ago, according to LSEG data.

This decline in Nvidia’s PE valuation is attributed to analysts significantly raising their forecasts for the company’s future earnings. However, if these projections prove to be overly optimistic, Nvidia’s stock could face a sharp correction.

Analysts are particularly interested in Nvidia’s expansion into cloud services, which it initiated last year by offering chips and software to developers as a cloud service. This move aims to keep developers reliant on Nvidia’s chips by providing them with essential tools such as CUDA, which facilitates running AI programs on Nvidia’s chips.

Moreover, there are concerns regarding Nvidia’s competition with Chinese rivals, particularly as Washington has restricted China’s access to Nvidia’s most advanced chips. Chinese companies have responded by developing chips, such as those from Huawei Technologies Co (HWT.UL), that rival Nvidia’s performance.

Despite these challenges, Nvidia is expected to maintain its technological edge over Chinese competitors. As Jimmy Goodrich, an expert on China and semiconductors, notes, Nvidia’s continuous advancements in silicon, software coding, and application stack will likely widen the gap between Nvidia and its Chinese counterparts over time.