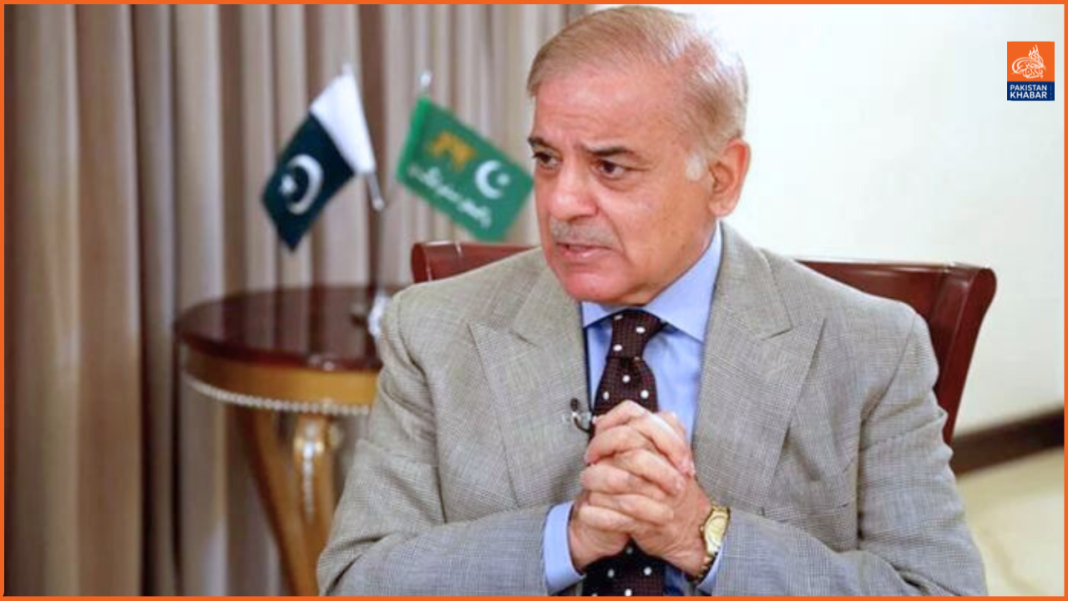

Prime Minister Shehbaz Sharif has recently taken significant steps to revamp the Federal Board of Revenue (FBR) by approving new measures that impose restrictions on compliant taxpayers and authorize substantial financial resources for modernization. Under the new guidelines, compliant taxpayers will be barred from purchasing assets that exceed their declared income sources. Furthermore, non-filers will be prohibited from acquiring major assets, a move aimed at ensuring greater accountability within the tax system.

During a recent meeting focused on the FBR’s transformation plan, Prime Minister Sharif firmly ruled out the introduction of a mini-budget to address ongoing revenue shortfalls. He emphasized the importance of enhancing tax collection efforts to cover an anticipated Rs200 billion deficit in the first quarter. The Prime Minister instructed FBR Chairman Rashid Langrial to take immediate action in this regard.

To support these initiatives, the Prime Minister approved an additional Rs34 billion package for the FBR. This funding will be used for various purposes, including the purchase of advanced scanning equipment, the establishment of new check posts along the River Indus to combat smuggling, and performance rewards for FBR staff. Furthermore, the plan includes hiring 1,560 private consultants for auditing purposes, a move that has raised some concerns about data privacy.

The transformation plan also aims to incentivize tax officials by leveraging digital tools to scrutinize income tax returns more effectively. However, there are concerns that targeting compliant taxpayers could inadvertently harm overall tax revenues. Participants in the meeting cautioned against implementing too many changes at once, emphasizing the need for a measured approach.

In addition to these reforms, the Prime Minister has proposed to introduce stricter measures against non-filers, including the denial of rights to purchase properties and open bank accounts. The government believes that most existing filers have under-declared their assets, and the new measures aim to rectify this issue.

Overall, these changes reflect a significant push by the government to enhance revenue collection and ensure that all taxpayers are held accountable. The emphasis on digitalization and transparency within the FBR highlights a commitment to modernizing Pakistan’s tax system while also addressing the challenges posed by smuggling and tax evasion. The effectiveness of these measures will largely depend on the successful implementation of the proposed initiatives and the cooperation of all stakeholders involved.