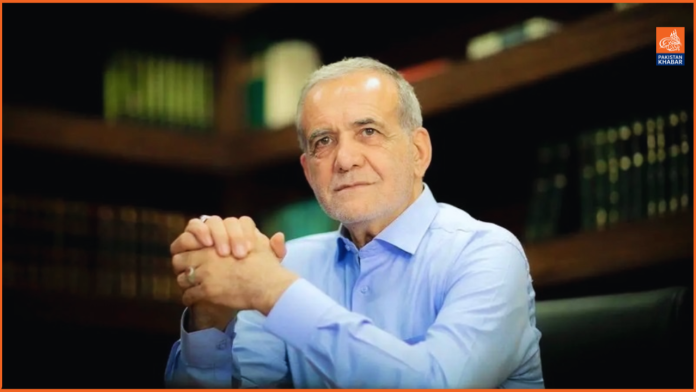

ایران کے صدر مسعود پزشکیان نے حالیہ بیانات میں واضح کیا ہے کہ ان کا ملک جنگ کی طرف نہیں جانا چاہتا۔ انہوں نے کہا کہ اسرائیل کی جانب سے جنگ کے حالات پیدا کرنے کی کوشش کی جا رہی ہے، جس کا مقصد ایک وسیع تنازع کو جنم دینا ہے۔ غیر ملکی خبر رساں ادارے کے مطابق، ایرانی صدر نے اس بات پر زور دیا کہ اسرائیل حزب اللّٰہ کی حمایت میں ایران کو اس تنازعے میں شامل کرنے کے لئے اکسا رہا ہے۔

انہوں نے کہا کہ ایران ہر اس گروہ کا دفاع کرے گا جو اپنے حقوق کی حفاظت کے لئے کوشاں ہے اور خود کا دفاع کر رہا ہے۔ مسعود پزشکیان نے اس بات کا عزم کیا کہ ایران امن کے ساتھ رہنے کا خواہاں ہے اور وہ مشرق وسطیٰ میں عدم استحکام کا باعث بننے کے لیے تیار نہیں ہے، کیونکہ ایسا کرنے کی صورت میں اس تنازع سے نکلنا ممکن نہیں ہوگا۔

اسی دوران، حزب اللّٰہ کے مواصلاتی آلات پر اسرائیلی حملوں کے بعد ایران کی پاسداران انقلاب نے تمام اراکین کو اپنے مواصلاتی آلات کے استعمال سے روکنے کا فیصلہ کیا ہے۔ ایرانی حکام نے اس بات پر زور دیا ہے کہ یہ اقدامات ملک کی سلامتی کو یقینی بنانے کے لئے ضروری ہیں۔ اس کے علاوہ، ایک سیکیورٹی اہلکار نے بتایا کہ صرف مواصلاتی آلات نہیں بلکہ تمام آلات کا معائنہ کرنے کے لیے ایک بڑے پیمانے پر آپریشن جاری ہے، تاکہ کسی بھی ممکنہ خطرے سے بچا جا سکے۔ یہ صورتحال ایران میں بڑھتے ہوئے خطرات کے پیش نظر ایک اہم قدم ہے۔